Squarespace has launched Squarespace Capital, a new funding option designed to give entrepreneurs quicker access to financing.

The program aims to streamline the borrowing process by offering a simplified application, flexible repayment terms and faster approvals compared with traditional bank loans.

According to the company, funds can be available to applicants within a few days of approval and can be used for a variety of purposes, such as opening new locations, expanding product lines, hiring staff, or increasing marketing spend.

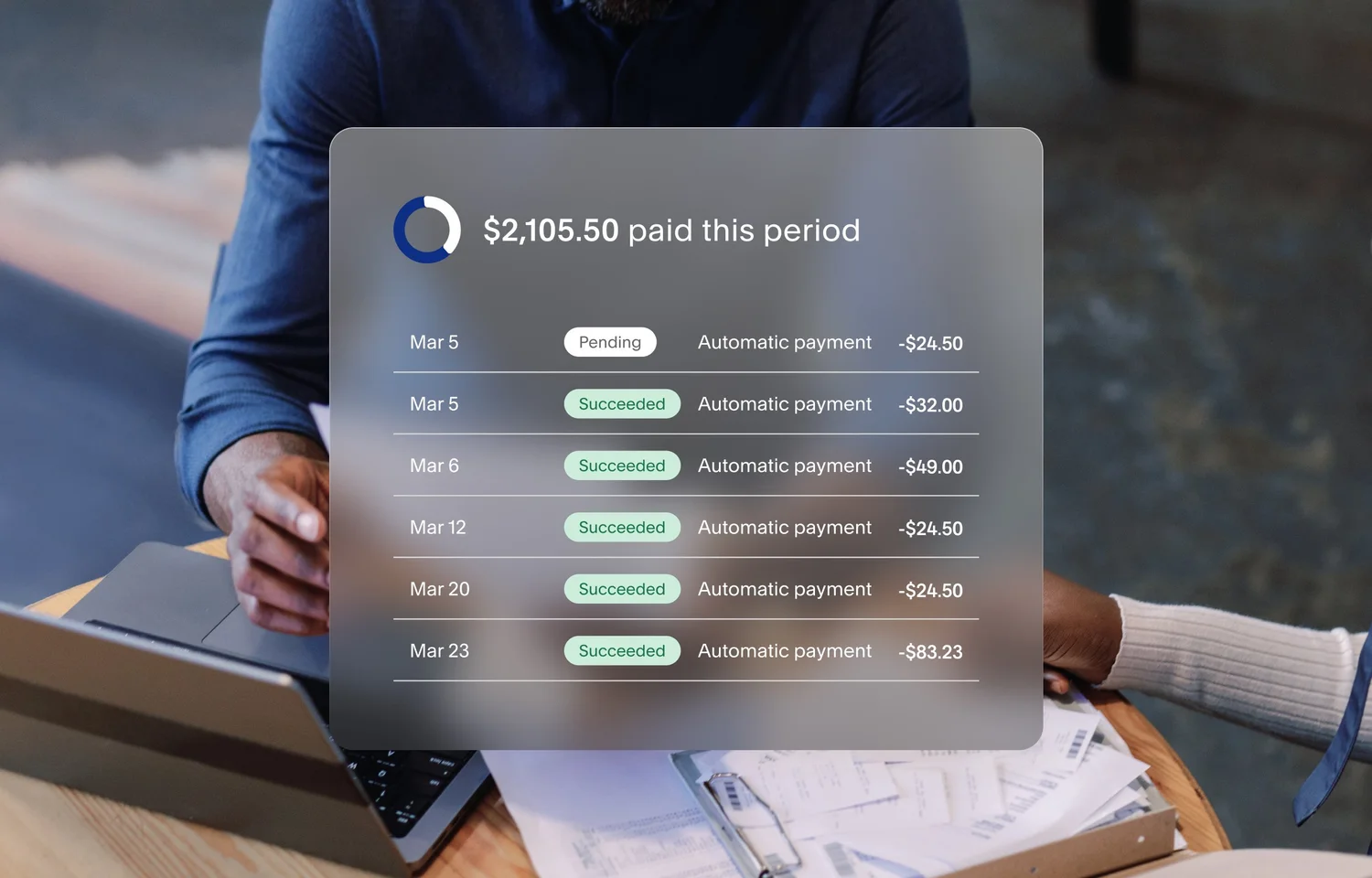

The key difference between Squarespace Capital and a traditional loan is that rather than interest being charged, a flat fee applies — and this fee is taken directly from any sales made via the applicant’s Squarespace site.

Paul Gubbay, Squarespace’s Chief Product Officer, framed the launch as part of a broader commerce strategy:

“With the launch of Squarespace Payments in 2023, we laid the foundation for a more robust commerce ecosystem. Squarespace Capital is a natural next step, expanding our support to provide access to the critical financial infrastructure businesses need to grow.”

According to the company, adoption has reportedly been strong, with recipients spanning industries including health and beauty, trades and home services, consulting, non-profits, membership organizations and retail.

In its announcement about the new financing solution, Squarespace also highlighted the introduction of Instant Payouts, a companion feature that allows businesses to transfer their Squarespace Payments earnings to bank accounts within minutes. Together, Squarespace Capital and Instant Payouts are positioned as a combined financial toolkit that caters for both immediate cash flow needs and longer-term growth.

Squarespace Capital is currently available to eligible customers in the United States and United Kingdom, with financing provided by Celtic Bank and YouLend, respectively. The service is powered by Stripe, and further international expansion is planned for 2025. Instant Payouts is currently available in the U.S., U.K., and Eurozone.

Why this matters to merchants

For online sellers, Squarespace’s combination of fast financing and Instant Payouts may help address two key challenges: fast access to growth capital and consistent cash flow.